EPFO Portal Login (UAN): Check PF Balance, Download Passbook & Track Claim Status

The Employees’ Provident Fund Organisation (EPFO) is a central government body that manages Provident Fund savings for millions of salaried employees across India. To simplify access to these services, EPFO offers an online login portal that allows both employees and employers to handle PF-related work quickly and securely.

By signing in through a single UAN login, members can check their PF balance, view or download the EPFO passbook, submit PF withdrawal requests, track claim status, and update personal or KYC information—all in one place. This digital platform reduces paperwork, saves time, and ensures greater transparency while giving employees complete visibility and control over their retirement funds.

What Is EPFO Login and Why It Is Important

EPFO Login is the official online access system provided by the Employees’ Provident Fund Organisation to help employees and employers manage Provident Fund (PF) services digitally. By logging in with a Universal Account Number (UAN) and password, members can securely access their PF account through the EPFO Unified Portal.

This online login system plays an important role in making PF services faster, more transparent, and easier to use. Earlier, employees had to depend on their company’s HR department or visit an EPFO office to get PF-related information. With EPFO login, all important services are available online, allowing employees to manage their PF account anytime and from anywhere.

EPFO login also ensures better transparency, as members can clearly see contributions made every month, interest credited, and the total PF balance. It gives employees complete control over their retirement savings while reducing paperwork and delays.

Key Benefits of EPFO Login

Using EPFO login, members can access multiple PF-related services from one platform:

- Check PF balance online to know the latest available amount

- View and download the EPFO passbook for contribution details

- Track PF claim status in real time after applying

- Apply for PF withdrawal online without office visits

- Update KYC and personal details such as Aadhaar, bank account, and PAN

- Manage PF account anytime without depending on employers or HR teams

For employers, EPFO login helps in timely PF compliance, accurate contribution deposits, and smooth record management. It also reduces errors and ensures transparency between employers and employees.

EPFO Passbook – Check PF Balance & Contribution Details

After completing EPFO login on the Unified Portal, members can access one of the most important features—the EPFO Passbook. The passbook is a digital record that shows complete details of Provident Fund contributions made by both the employee and the employer.

The EPFO passbook allows members to track their PF savings on a monthly basis. It clearly shows how much money is deposited every month, how interest is added, and how the total PF balance grows over time. This helps employees plan their long-term savings and retirement more effectively.

Details Shown in the EPFO Passbook

The EPF passbook provides a clear and detailed breakup of your PF account, including:

- Employee contribution (12% of basic salary and DA)

- Employer contribution (3.67% deposited into EPF)

- Pension contribution under EPS (part of employer share)

- Interest credited on the PF balance every year

- Total available PF balance

- Month-wise contribution history for each employment period

By checking the EPFO passbook regularly, members can verify employer contributions, identify missing deposits, and ensure their PF account is properly maintained.

How to Check EPFO Passbook Online

Checking your EPFO passbook online is a simple process once you complete EPFO login. The passbook is available on the EPFO Unified Portal and allows you to view your PF balance, monthly contributions, and interest details in one place.

Follow the steps below to access your EPFO passbook online:

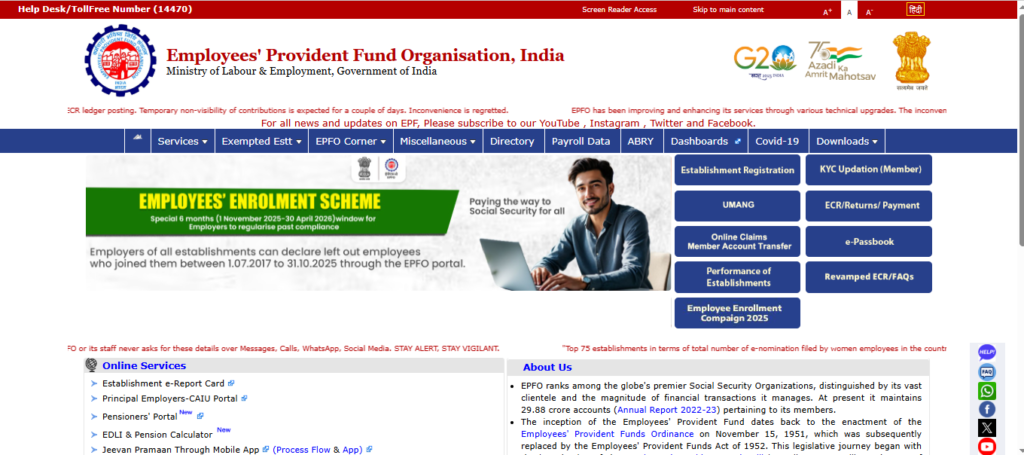

- Visit the official EPFO website: Open any web browser on your mobile or computer and go to the official Employees’ Provident Fund Organisation website.

- Click on the “Services” option: On the homepage, locate the Services menu at the top of the page.

- Select “For Employees”: Under the Services section, click on For Employees to access employee-related PF services.

- Click on “Member Passbook”: From the available options, select Member Passbook. This will redirect you to the EPF passbook login page.

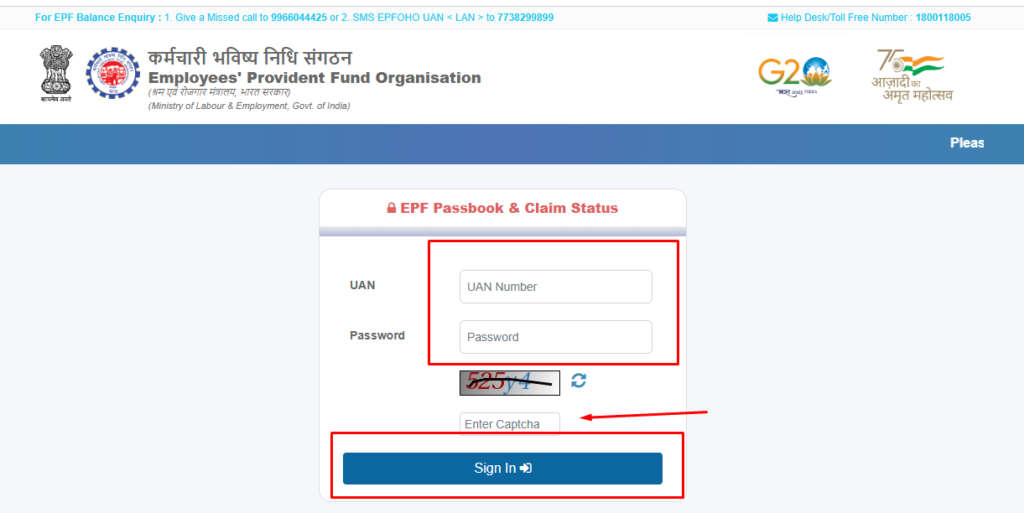

- Log in using UAN and password: Enter your Universal Account Number (UAN), EPFO password, and the captcha code displayed on the screen.

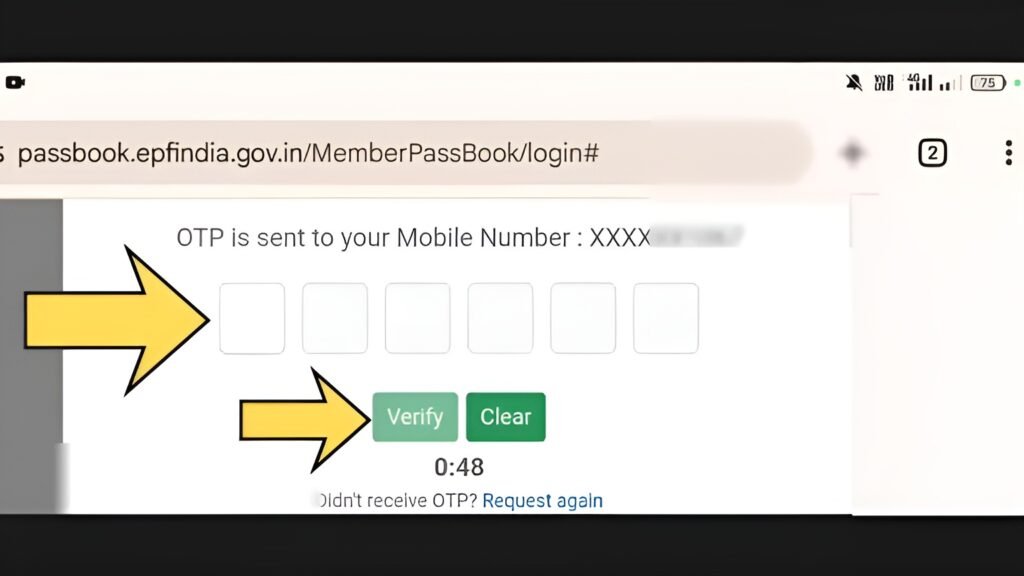

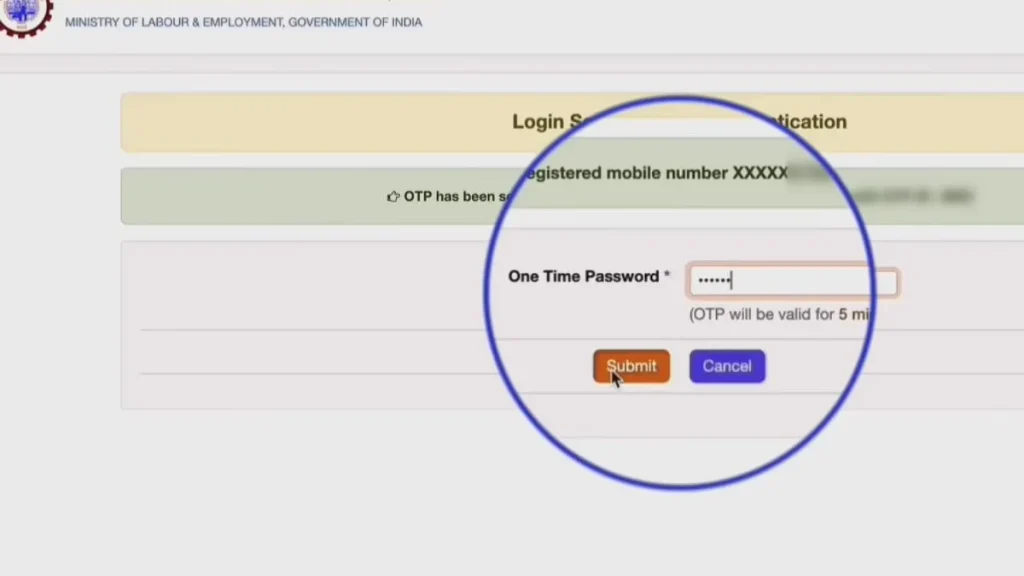

- Verify OTP sent to registered mobile number: An OTP will be sent to the mobile number linked with your UAN. Enter the OTP to complete verification.

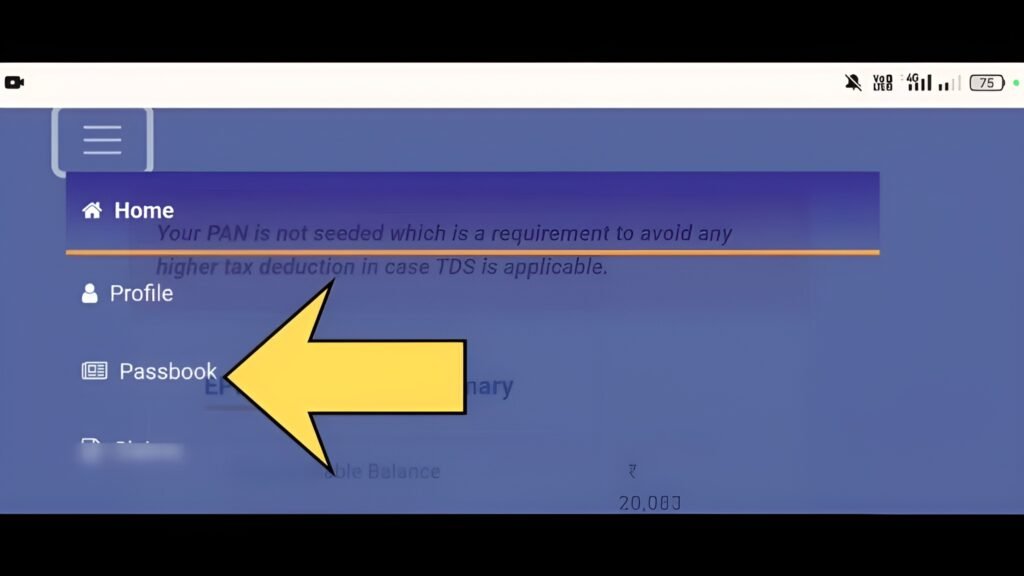

- View your EPFO passbook: After successful verification, your EPF passbook will open.

You can now easily view:

- PF balance

- Month-wise contribution details

- Employee and employer shares

- Interest credited to your account

The EPFO passbook is updated regularly and can be accessed anytime, helping you track your PF savings without visiting an EPFO office.

Understanding Employee and Employer Contributions in EPF Passbook

When you open your EPFO passbook after logging in, you will notice separate columns showing contributions made by the employee and the employer. Understanding these entries helps you know exactly how your Provident Fund savings are built every month.

Employee Contribution

The employee share is the amount deducted directly from your monthly salary.

- 12% of your basic salary and dearness allowance (DA) is contributed to the EPF account.

- This amount is fully credited to your Provident Fund and earns interest every year.

This contribution forms the core of your PF savings.

Employer Contribution

The employer share is contributed by your company and does not reduce your salary.

- Out of the employer’s total 12% contribution, 3.67% is added to your EPF account.

- This amount also earns interest and is shown separately in the passbook.

Pension Contribution (EPS)

A portion of the employer’s contribution goes towards your pension under the Employees’ Pension Scheme (EPS).

- 8.33% of the employer’s share is deposited into the pension account.

- This amount does not appear in the PF balance but is used to provide a monthly pension after retirement, subject to eligibility.

How These Contributions Build Your PF Balance

Together, the employee contribution, employer EPF contribution, and yearly interest create your total PF balance. The pension contribution supports long-term retirement benefits separately through EPS.

By regularly checking your EPFO passbook, you can ensure:

- Salary deductions are correct

- Employer contributions are deposited on time

- Your PF balance is growing as expected

This transparency makes the EPFO passbook a reliable tool for tracking and managing your retirement savings.

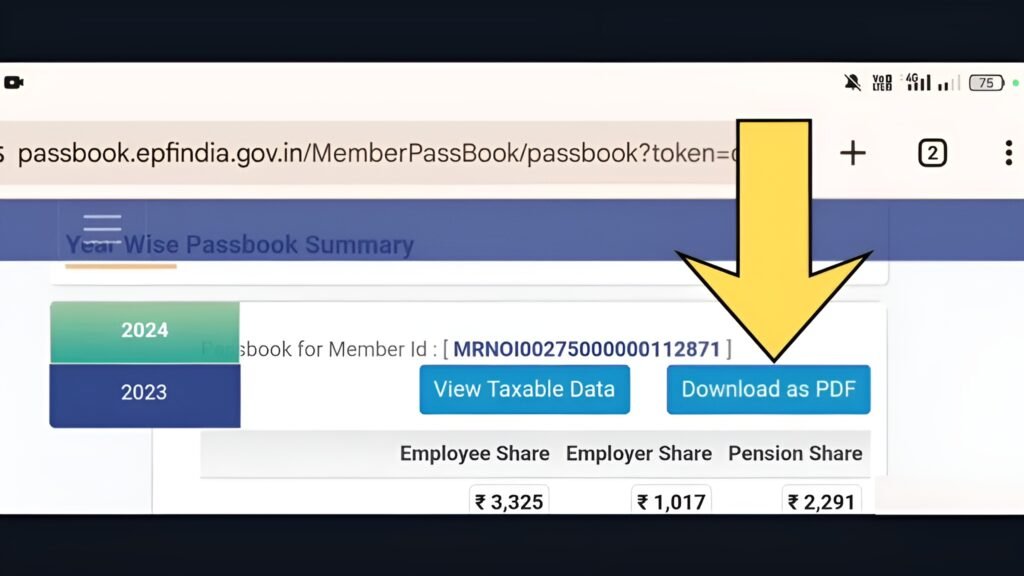

How to Download EPFO Passbook PDF

The EPFO portal allows members to download their EPF passbook in PDF format for personal records and offline use. This is useful when you need PF details for loan applications, verification purposes, or future reference.

Follow the steps below to download your EPFO passbook PDF after logging in:

Open your EPF passbook

After completing EPFO login, go to the Member Passbook section and select the PF account you want to view.

Click on the “Download as PDF” option

Once the passbook opens, look for the Download PDF or Download as PDF option on the page.

Save the PDF file on your device

The passbook will be downloaded as a PDF file. Save it on your mobile phone, computer, or cloud storage for easy access later.

What Information Is Available in the EPFO Passbook PDF

The downloaded EPFO passbook PDF contains complete and updated PF details, including:

- Employee and employer contribution records

- Pension (EPS) contribution details

- Month-wise PF deposit history

- Interest credited to the PF account

- Total available PF balance

Since the file is in PDF format, it can be viewed anytime without internet access and shared whenever PF details are required.

Why Downloading the EPFO Passbook Is Useful

Downloading the EPFO passbook PDF helps members to:

- Maintain a personal PF record

- Verify employer contributions

- Track PF savings over time

- Use PF details for official or financial purposes

Regularly downloading and checking your EPFO passbook ensures transparency and helps you stay informed about your retirement savings.

EPFO Login – Step-by-Step Guide to Sign In

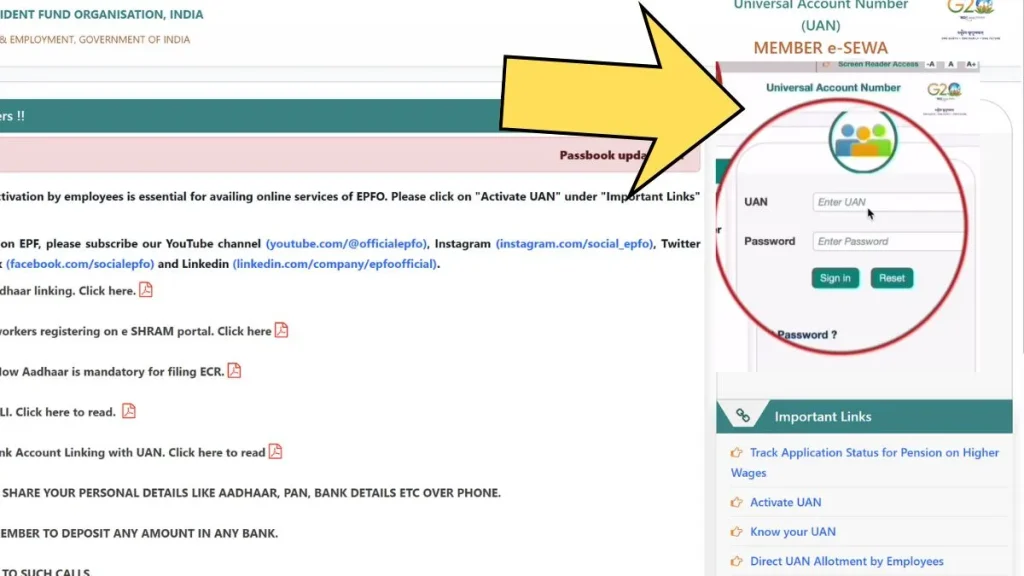

The EPFO login portal allows employees to access their Provident Fund account online using their Universal Account Number (UAN). Whether you are using a mobile phone or a desktop computer, the login process remains the same and can be completed in just a few minutes.

Before you begin, ensure that your UAN is active and your mobile number is linked, as OTP verification is required during login.

Details Required for EPFO Login

To successfully sign in to the EPFO Unified Portal, keep the following details ready:

- UAN (Universal Account Number) provided by EPFO

- EPFO login password created at the time of UAN activation

- Registered mobile number linked with your UAN to receive OTP

- Working internet connection for smooth access

Having these details available helps avoid login delays or errors.

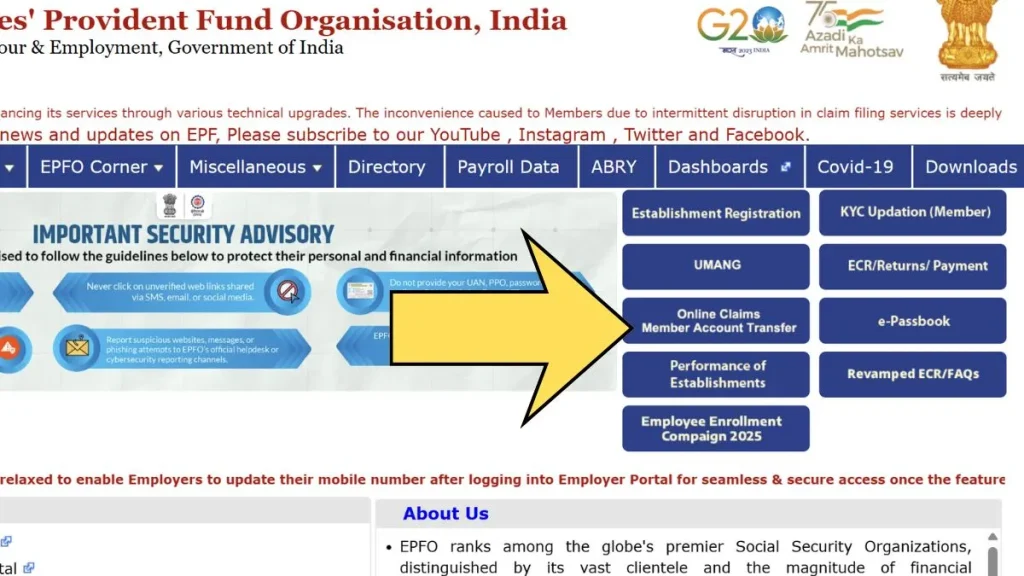

Steps to Login to EPFO Portal

Follow these simple steps to access your EPFO account online:

- Open the official EPFO website

Use any web browser on your mobile or computer and visit the official EPFO portal. - Go to the “Services” section

On the homepage, click on the Services option available in the main menu. - Choose “For Employees”

Under the Services menu, select For Employees to view employee-related services. - Click on “Member UAN / Online Services”

This option will redirect you to the EPFO member login page. - Enter your login credentials

Type your UAN, password, and the captcha code shown on the screen. - Click the “Sign In” button

After entering the details, click Sign In to continue. - Verify the OTP

An OTP will be sent to your registered mobile number. Enter the OTP to confirm your identity. - Access your EPFO dashboard

Once the OTP is verified, you will be logged in successfully and redirected to your EPFO dashboard.

From the dashboard, you can easily check your PF balance, view or download the EPFO passbook, apply for PF withdrawal, track claim status, and update your personal or KYC details—all from one place.

Services Available After EPFO Login

Once you log in to the EPFO portal using your UAN, a range of important services becomes available. These services are designed to help you manage your Provident Fund (PF) account efficiently, track contributions, and submit requests—all without visiting an EPFO office. Below is a detailed overview of the main services you can access after login:

EPF Passbook – Check PF Balance & Contributions

The EPF Passbook is a digital record of all PF contributions made by both you and your employer.

- You can check your current PF balance, month-wise contributions, and interest earned.

- The passbook helps you track how your PF savings grow over time.

- You can also download the passbook as a PDF for your personal records or official purposes.

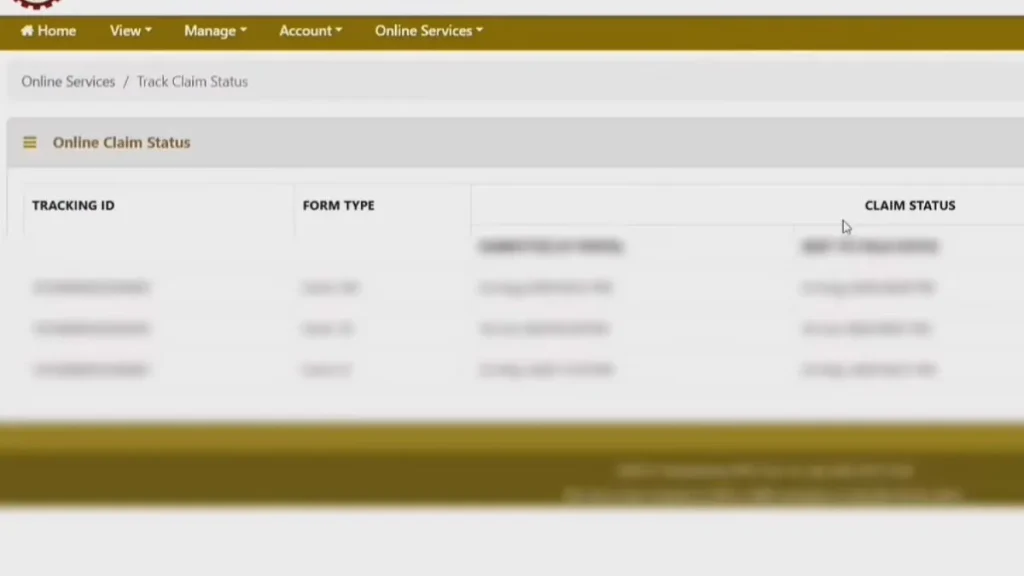

Claim Status – Track PF Withdrawal

The Claim Status service allows you to track the progress of any PF withdrawal or transfer request you have submitted.

- You can see whether your claim is pending, under process, or settled.

- It helps avoid unnecessary follow-ups with your employer or EPFO office.

- If a claim is rejected, the portal provides the reason for rejection so you can take corrective action.

Online Claim – Apply for PF Withdrawal

The Online Claim service allows you to apply for full or partial PF withdrawal from the comfort of your home.

- You can select the type of claim, such as Form 19 for final settlement, Form 10C for pension withdrawal, or Form 31 for partial withdrawal.

- You can also specify the PF account and purpose of the withdrawal.

- After submitting the claim, you receive an OTP for verification and a confirmation receipt.

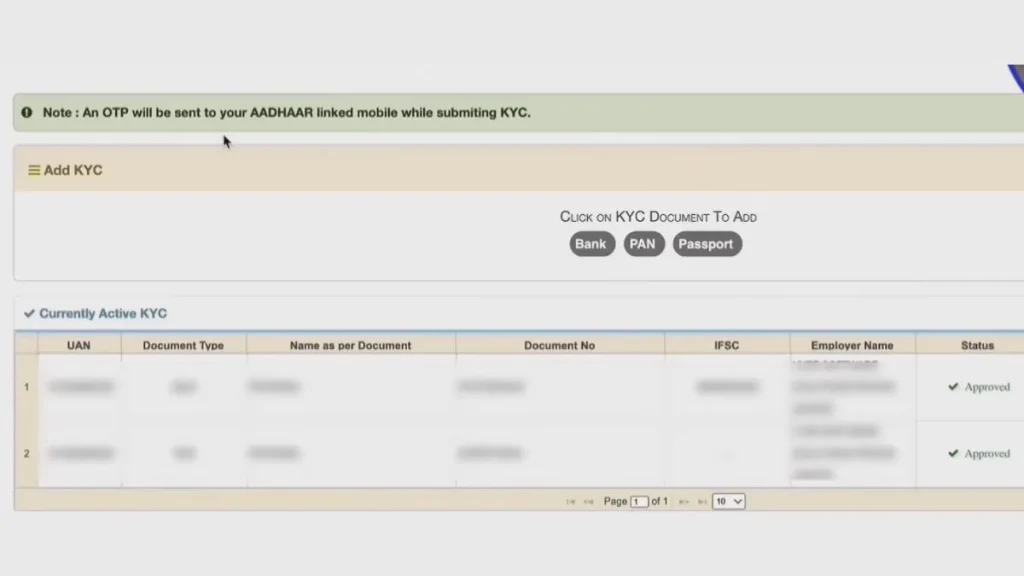

KYC Details – Update Aadhaar, Bank, PAN

The KYC (Know Your Customer) Details section allows you to update and verify essential personal information linked to your PF account.

- You can add or update Aadhaar, PAN, and bank account details.

- Approved KYC details are necessary for PF withdrawal or transfer.

- Keeping your KYC updated ensures faster claim settlement and avoids rejection.

Profile – View and Update Personal Details

The Profile section displays all your personal details registered with EPFO.

- You can view your name, date of birth, contact information, and employment details.

- You can also update or correct details if needed.

- Regularly reviewing your profile ensures that all PF-related communications and payments are accurate.

Common EPFO Login Problems & How to Solve Them

While logging in to the EPFO portal is usually straightforward, some members may face common issues. Here’s a guide to help you troubleshoot and resolve them quickly:

| Issue | Solution |

|---|---|

| OTP not received | Ensure your mobile number is correctly linked with your UAN. If correct, check network connectivity or try requesting the OTP again. |

| Wrong password | Use the “Forgot Password” option on the login page to reset your EPFO password securely. |

| Invalid UAN | Verify that your UAN is activated and correctly entered. Contact EPFO support if the problem persists. |

⚠️ Tip: Always make sure your mobile number is active and linked to your UAN, as OTP verification is required for all login attempts.

Why EPFO Login Is Important

The EPFO Login is the central gateway for managing your Provident Fund account online. Using your Universal Account Number (UAN) and password, you can access a wide range of services anytime, without visiting an EPFO office.

Key Benefits of EPFO Login

- Access PF Account Anytime

View your PF account whenever you need it—no office visits required. - Check PF Balance Online

Quickly see your current balance, including employee and employer contributions, and track interest earned. - View and Download Passbook

Keep a digital record of your PF contributions and download the passbook in PDF format for personal or official use. - Apply and Track PF Claims

Submit online claims for PF withdrawal or transfer and monitor their status in real time. - Manage PF Details Without Office Visits

Update KYC information such as Aadhaar, PAN, and bank details directly on the portal, ensuring smooth processing of claims.

By providing secure, easy, and centralized access, the EPFO login portal serves as the main entry point for all PF-related services. It empowers employees with transparency, control, and convenience over their retirement savings.

EPFO Member Login vs Employer Login – Key Differences

The EPFO portal provides two types of logins—one for employees and one for employers. Each serves a different purpose and gives access to specific services.

EPFO Member Login (Employee Login)

The EPFO Member Login is designed for individual employees. Using the member portal, employees can:

- Manage their PF account – View contributions, balances, and interest earned.

- Check the EPFO passbook – Access a detailed record of monthly contributions.

- Submit online PF claims – Apply for partial or full PF withdrawals.

- Track claim status – Monitor the progress of submitted claims in real time.

This login is exclusively for personal PF management. Employees should always use the member portal for their own PF-related services.

EPFO Employer Login

The EPFO Employer Login is intended for companies to manage employee PF contributions and compliance. Employers can:

- Deposit monthly PF contributions for employees.

- Manage regulatory compliance with EPFO rules.

- Maintain employee PF records accurately.

Employees should not use the employer login for personal PF management.

EPFO Claim Process – How to Withdraw PF Online

After logging into the EPFO portal, members can withdraw money from their PF account online. When all details are correct, claims are often settled quickly, sometimes within 24 hours. Following the correct process and completing necessary checks ensures faster claim approval.

Important Checks Before PF Withdrawal

Before submitting a withdrawal request, make sure:

- Your UAN is active.

- You are logged in to the EPFO Unified Portal.

- Your KYC details are updated and approved (Aadhaar, PAN, bank account).

- Your profile details match KYC documents.

Completing these steps increases the chances of fast, hassle-free settlement.

Step 1: Login to EPFO Portal for Claim

- Open the official EPFO website.

- Click on Online Claim / Member Account Transfer.

- Log in using your UAN and password.

- Enter the OTP sent to your registered mobile number.

- Once verified, the EPFO dashboard will open.

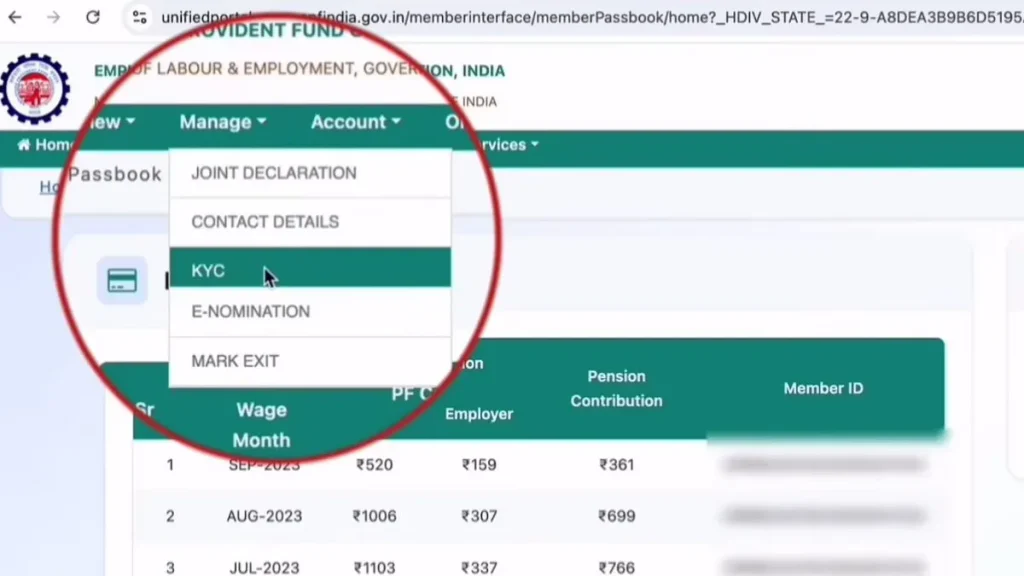

Step 2: Verify Your KYC Status

Before submitting any PF withdrawal or claim, it is crucial to check your KYC (Know Your Customer) status. KYC verification ensures that your identity and bank account details are correct, which helps EPFO process your claim securely and efficiently.

⚠️ Important: PF withdrawal cannot be processed if your KYC details are incomplete or not approved.

How to Check Your KYC Status

- Log in to the EPFO portal using your UAN and password.

- Navigate to Manage → KYC on your dashboard.

- On the KYC page, check the status of your documents:

- Aadhaar – Must be approved for identity verification.

- PAN – Required for tax purposes.

- Bank account details – Must be verified to receive PF payments.

- If any KYC detail is pending or not updated, click Add/Update KYC, submit the required documents, and wait for EPFO approval.

Why KYC Verification Matters

- Secure Transactions: Ensures PF withdrawals are credited to the correct bank account.

- Faster Claim Processing: Claims with approved KYC are often settled quickly, sometimes within a few days.

- Avoid Claim Rejections: Incomplete or incorrect KYC is one of the most common reasons for delayed or rejected claims.

Regularly checking and updating your KYC before applying for a claim guarantees a smooth, hassle-free PF withdrawal process.

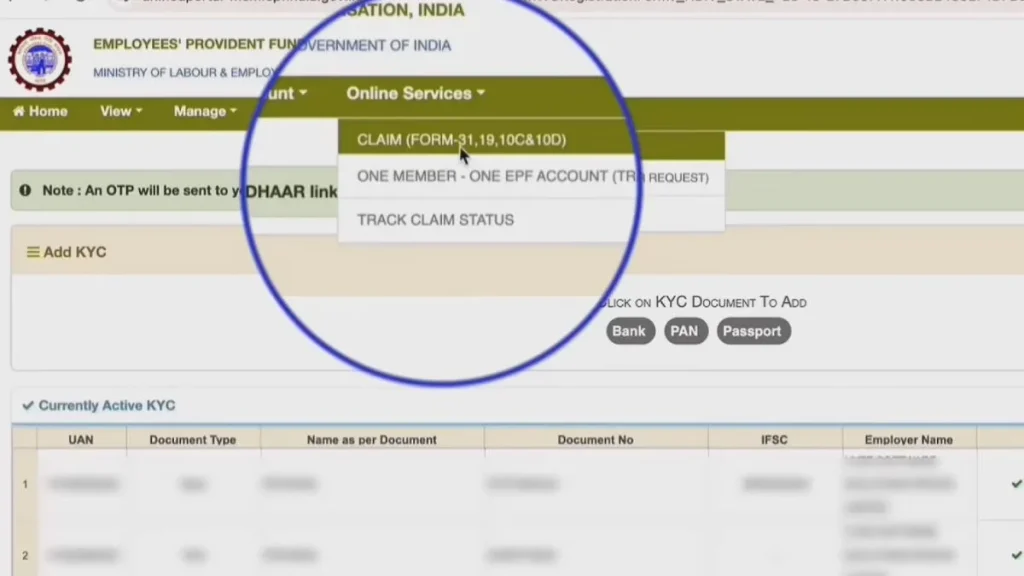

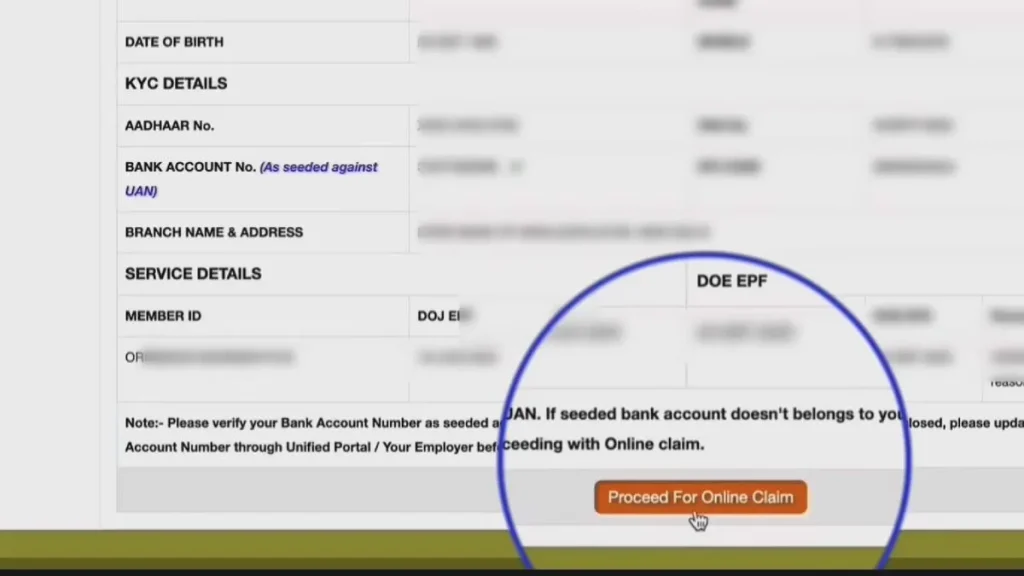

Step 3: Apply for PF Withdrawal Online

Once your KYC is verified:

- Go to Online Services → Claim → PF Withdrawal Online.

- Verify your bank account details.

- Click Proceed for Online Claim.

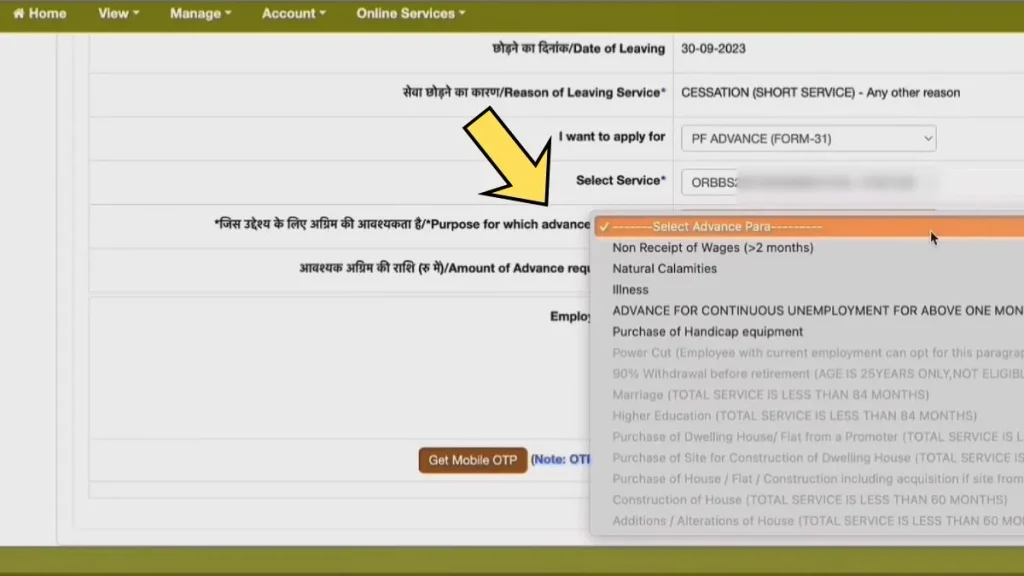

- Select the appropriate claim form based on your requirement:

| Form | Used For |

|---|---|

| Form 31 | Partial PF withdrawal (while still working) |

| Form 19 | Final PF settlement |

| Form 10C | Pension withdrawal |

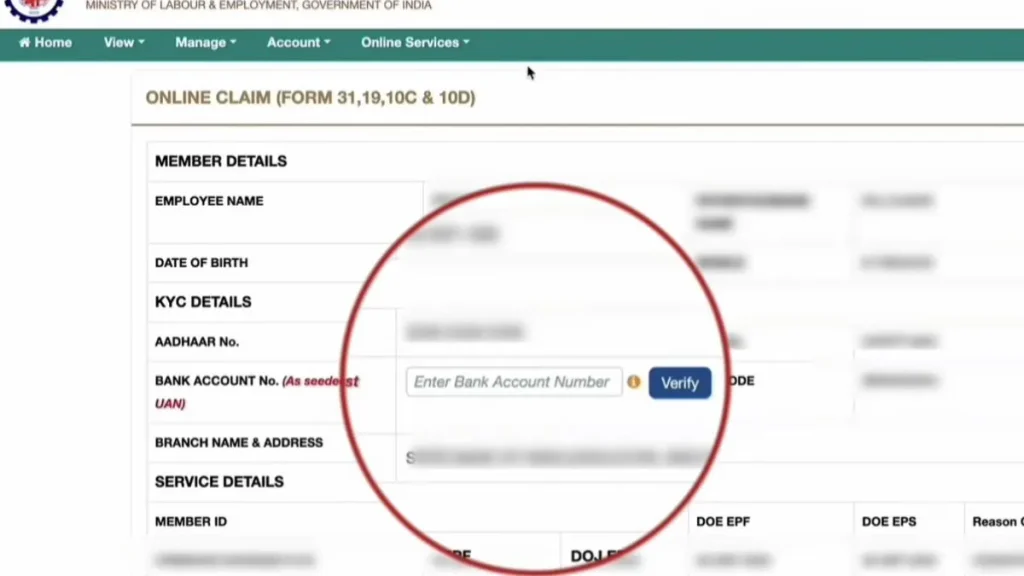

Submit Your PF Withdrawal Claim

- Select the PF Account and Reason for Withdrawal

Choose the specific PF account from which you want to withdraw funds and select the reason for your withdrawal (e.g., final settlement, partial withdrawal, or pension withdrawal).

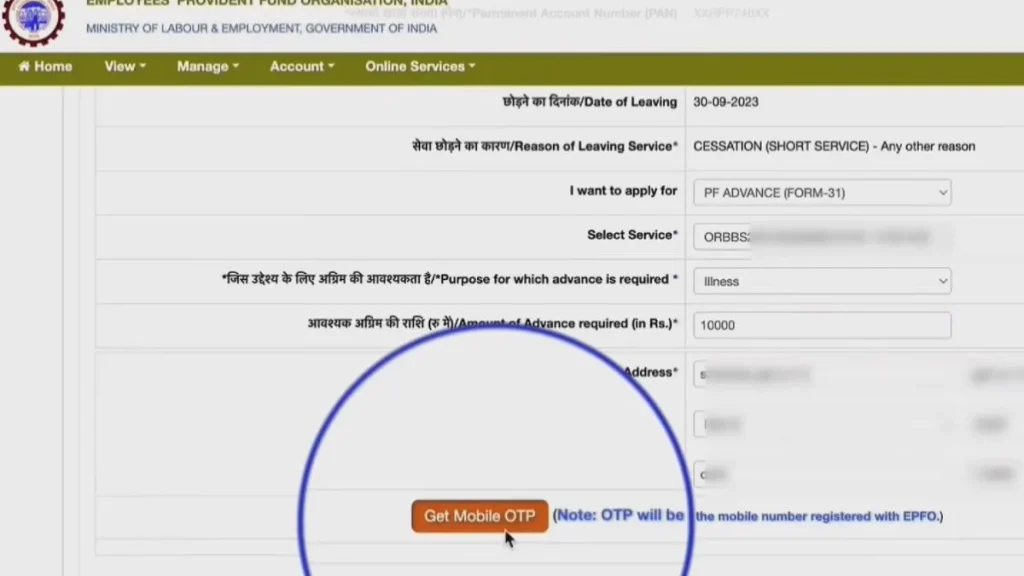

- Enter Withdrawal Details

Fill in the amount you wish to withdraw and provide your current address as per Aadhaar to ensure accurate verification.

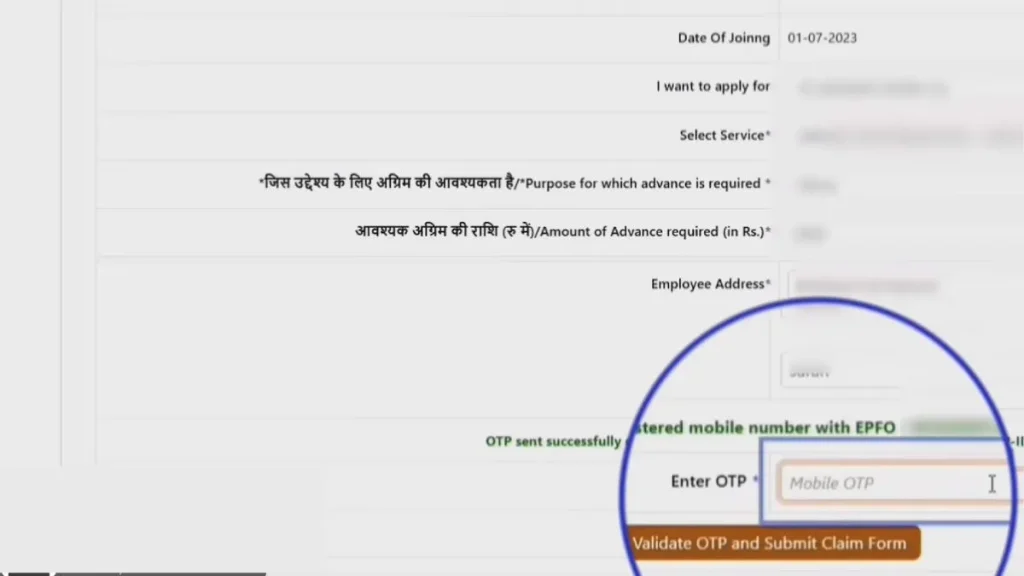

- OTP Verification

Click Get Mobile OTP. An OTP will be sent to your registered mobile number. Enter the OTP in the portal to confirm your identity.

- Validate and Submit the Claim

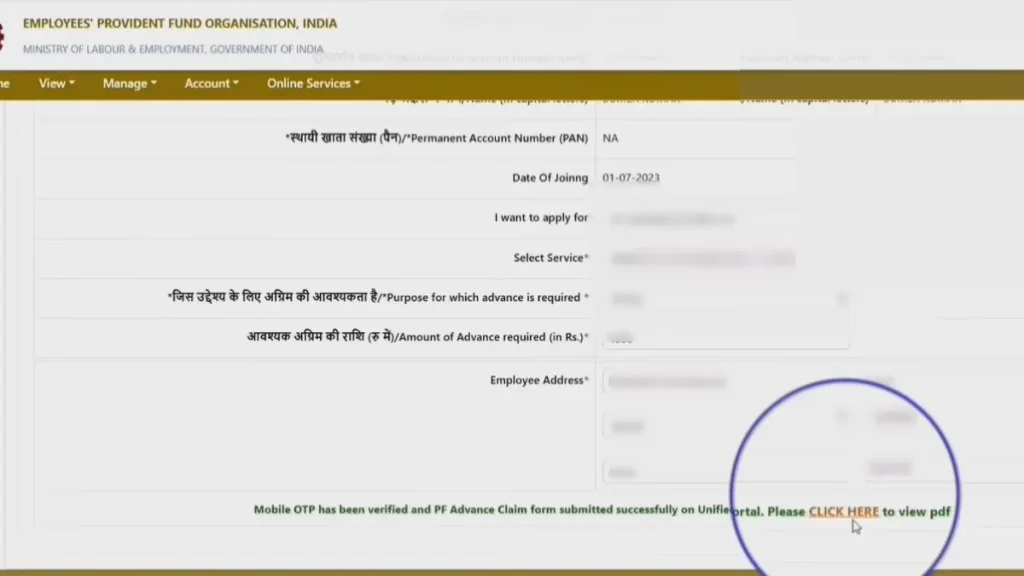

After entering the OTP, click Validate & Submit Claim. Once submitted, your PF withdrawal request is successfully filed, and you will receive a confirmation on the screen.

Tip: Download or save the acknowledgement for future reference, as it serves as proof of your claim submission.

Step 4: Download Claim Acknowledgement

Once your claim is submitted:

- A confirmation message appears on the screen.

- Click Download Acknowledgement and save the PDF for future reference.

This serves as proof of your claim submission and can be used for tracking purposes.

Step 5: How to Get PF Claim Settled Faster

To increase the chances of auto-settlement:

- Ensure all KYC details are approved.

- Make sure your profile details match your KYC documents.

- Verify that your bank account details are correct.

If everything is correct, your claim will usually go into auto-settlement mode, speeding up processing.

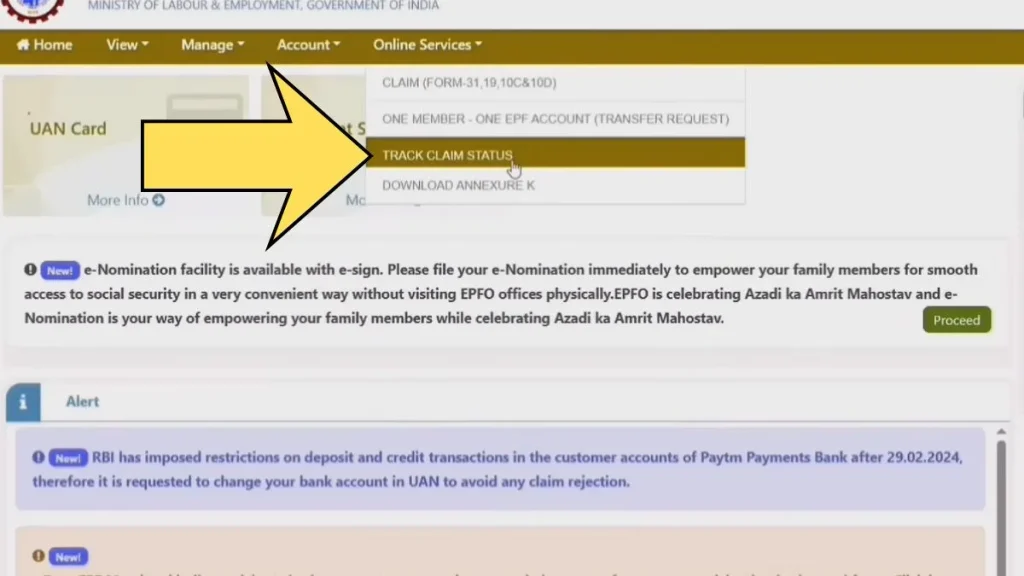

Step 6: Check PF Claim Status

If the claim is not settled immediately:

- Log in to the EPFO portal.

- Go to Online Services → Track Claim.

- View the current status of your claim.

- If rejected, check the reason for rejection and make necessary corrections before resubmitting.

Regularly tracking your claim ensures that you are aware of its progress and helps resolve any issues quickly.

Understanding the difference between member login and employer login is crucial. Using the EPFO member portal, employees can manage their PF account, submit withdrawals, and track claims efficiently. Following the correct steps and keeping KYC and profile details updated ensures fast and hassle-free PF claim settlement.

Frequently Asked Questions (FAQs) About EPFO Portal

Managing your Provident Fund (PF) account can sometimes be confusing, especially with all the online services, UAN login, KYC updates, and claim processes. To help you navigate the EPFO portal more easily, we’ve compiled answers to the most commonly asked questions by employees.

Whether you want to check your PF balance, withdraw funds, update details, or track claims, this FAQ section covers everything you need to know to manage your EPF account efficiently and avoid common pitfalls.

1. How can I check my EPFO balance without logging in?

You can check your PF balance without logging in using one of the following methods:

- Missed Call: Give a missed call from your registered mobile number to the EPFO balance check number.

- SMS Service: Send an SMS in the prescribed format to the EPFO designated number.

- UMANG App: Download the UMANG app and use it to check your PF balance instantly.

2. How long does EPFO claim settlement take?

Typically, EPFO claims are settled within 3 to 7 working days if all your KYC and bank details are correct. Some claims may even be processed faster under the auto-settlement system.

3. Can I withdraw my pension amount from EPFO?

Yes, you can withdraw your pension under the following conditions:

- If your total service is less than 10 years, you can withdraw the accumulated pension amount.

- If your service is 10 years or more, you become eligible for a monthly pension after retirement instead of a lump sum.

4. Is a single EPFO login enough for all services?

Yes, one UAN login gives you access to:

- EPF Passbook – View and download contribution history.

- Online Claims – Apply for partial or full PF withdrawals.

- Claim Status – Track submitted PF claims.

- Profile Management – Update personal details and KYC information.

5. How can I update my bank details in EPFO?

- Log in to the EPFO portal using your UAN.

- Go to Manage → KYC.

- Add or update your bank account number and IFSC code.

- Submit the details for verification by your employer or EPFO.

✅ Ensure that your bank account details match the Aadhaar-linked account for smooth PF withdrawals.

6. What are NCP days in EPFO passbook?

NCP (Non-Contributory Period) days appear in your EPF passbook when no contributions are made during certain periods, such as:

- Unpaid leave

- Salary delays

- Temporary absence from work

These days are deducted from the total PF contributions for that month.

7. How to reset EPFO password if my mobile number has changed?

- Update your mobile number on the EPFO portal through Aadhaar verification.

- Once the number is updated, use the “Forgot Password” option to reset your EPFO login password securely.

8. How can I track my PF claim if it is delayed?

- Log in to the EPFO portal.

- Go to Online Services → Track Claim.

- Check the current status of your claim.

- If the claim is rejected, note the reason for rejection, correct the issue, and resubmit.

9. Can I withdraw PF partially while still employed?

Yes, you can apply for partial PF withdrawal using Form 31 for specific purposes such as:

- Medical emergencies

- Education

- Home purchase or repair

- Marriage expenses

⚠️ Ensure that your KYC and profile details are up to date for smooth processing.

10. Can I download my EPF passbook?

Yes, after logging in with your UAN:

- Go to Services → For Employees → Member Passbook.

- View your contribution history and download the passbook as a PDF for records.

Final Thoughts: Managing Your EPF Account Effectively

The EPFO portal is designed to make managing your Provident Fund simple, secure, and transparent. Whether you want to check your PF balance, download your passbook, update KYC details, or apply for withdrawal, the portal gives you complete control over your retirement savings.

By keeping your UAN active, ensuring all KYC and profile details are up to date, and regularly monitoring your PF account, you can avoid delays and enjoy a hassle-free experience with your PF transactions.

Remember, EPFO login is your gateway to all PF-related services, and understanding how to use it efficiently will help you make the most of your retirement benefits.

💡 Tip: Regularly log in to your EPFO account to track contributions and check for any discrepancies. Early action can prevent delays when it’s time to withdraw or transfer your PF.