EPFO Claim Status – Complete Guide to Track PF Claim Online Easily

Withdrawing money from your Provident Fund (PF) is often linked to important life moments—changing jobs, facing a medical emergency, planning a wedding, buying a home, or preparing for retirement. After submitting a PF withdrawal or transfer request, the most common concern among members is whether the claim is being processed smoothly or delayed for some reason. This is exactly why checking your EPFO claim status becomes a crucial step.

The Employees’ Provident Fund Organisation (EPFO) has made this process simple by offering an online claim tracking facility through its official Unified Member Portal. Using this service, members can check the real-time progress of their PF claim from the comfort of their home, without visiting any EPFO office or relying on intermediaries.

In this detailed guide, you will understand what EPFO claim status means, who can check it, how to track it step by step, what each status message indicates, why claims get rejected, how long settlement usually takes, and practical tips to receive your PF money faster.

What Is EPFO Claim Status?

EPFO claim status shows the current progress stage of your PF-related request after it has been submitted online. Whether you have applied for partial withdrawal, final settlement, pension withdrawal, or PF transfer, the claim status helps you know what is happening with your application.

It clearly indicates whether:

- Your request has been successfully received

- Verification is in progress

- The claim has been approved

- Payment has been processed

- The amount has been credited to your bank account

- Or if the claim has been rejected due to an issue

By regularly checking the claim status, members can stay informed and avoid unnecessary delays or confusion.

Benefits of Checking EPFO Claim Status

Tracking your PF claim status allows you to:

- Confirm that your application has been submitted correctly

- Understand if the claim is moving forward or stuck

- Identify errors or mismatches early

- Take timely corrective action if required

- Feel confident and stress-free about your PF savings

The status shown on the EPFO portal is updated regularly and reflects the latest processing stage of your claim.

Who Can Check EPFO Claim Status?

The EPFO claim status facility is available to all eligible members, including:

- Employees who have applied for PF withdrawal or transfer

- Members who have recently changed jobs

- Pensioners who have applied for pension-related claims

- Individuals who have exited employment and applied for final settlement

To check the status, you must have:

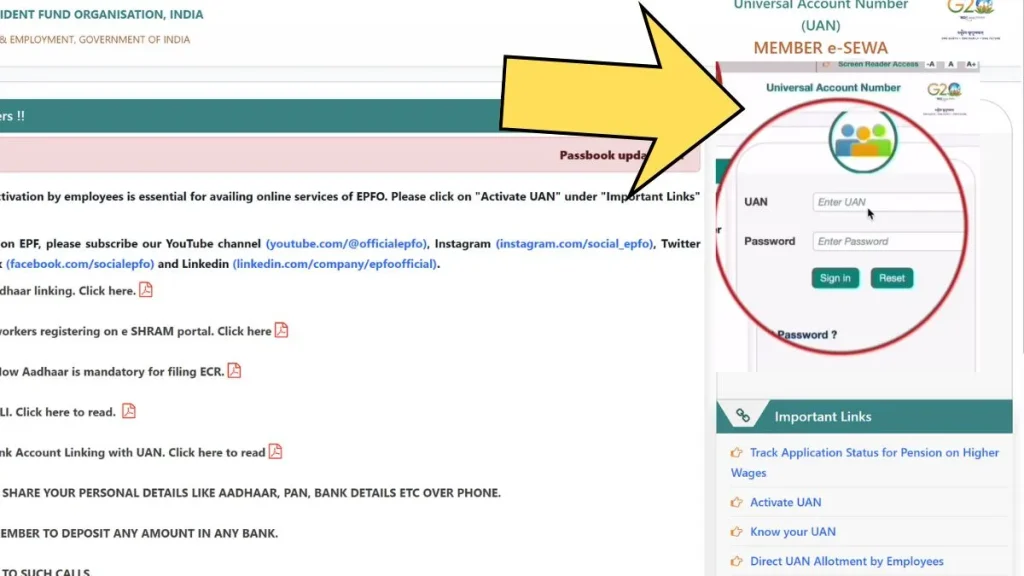

- A valid and active UAN (Universal Account Number)

- A mobile number linked with your UAN

- A claim that has already been submitted through EPFO

If these basic requirements are met, you can easily track your claim online.

Information Needed to Check EPFO Claim Status

Before starting the process, it is important to keep certain details ready to avoid interruptions.

You will need:

- UAN (Universal Account Number) – your unique EPFO identification

- Registered mobile number – to receive OTP for verification

- Stable internet connection – for smooth portal access

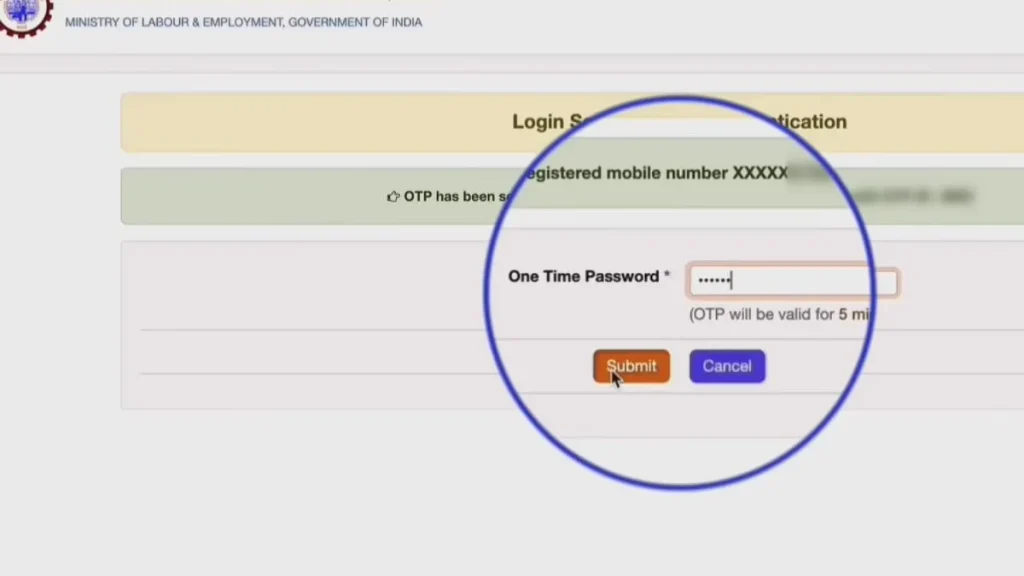

- Access to your mobile phone – to complete OTP authentication

Ensuring that your mobile number is active and linked to your UAN is especially important, as OTP verification is mandatory for EPFO login.

Step-by-Step Process to Check EPFO Claim Status Online

EPFO has designed a user-friendly process to help members track their claims easily. Follow these steps carefully:

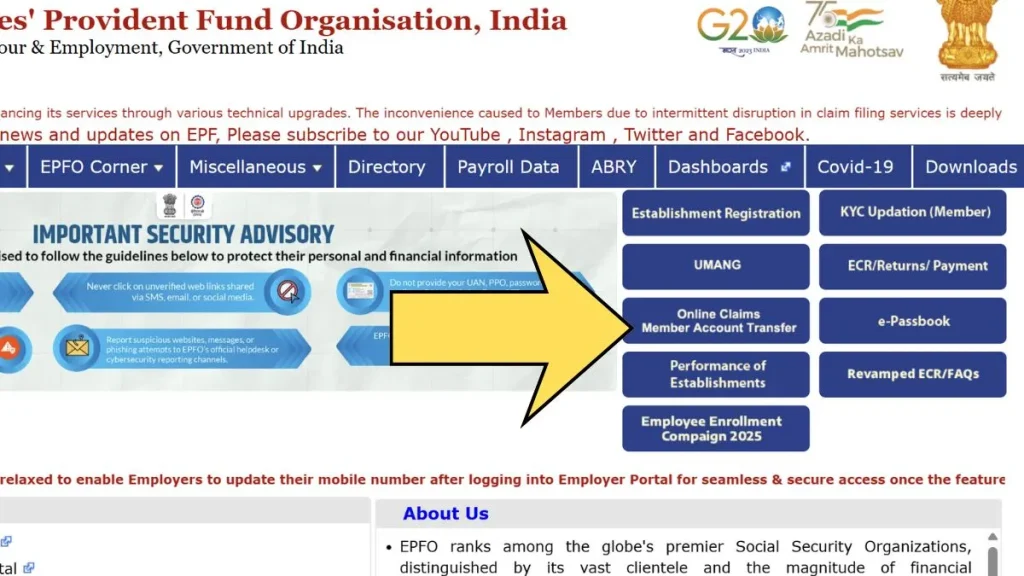

- Open the official EPFO Member Portal

- Navigate to the Services section on the homepage

- Click on For Employees

- Select Track Claim Status from the available options

- Log in using your UAN and password

- Enter the OTP sent to your registered mobile number

- After successful verification, your current EPFO claim status will be displayed

The status page typically shows:

- Claim type (Form 31, 19, 10C, etc.)

- Date of claim submission

- Current processing stage

- Remarks, if any

This information helps you clearly understand the progress of your claim.

Can You Check EPFO Claim Status Without Login?

In certain cases, EPFO allows members to check claim status without full login access. This option can be useful if you have forgotten your password or are facing temporary login issues.

However, it is important to note that:

- The information available without login is limited

- Detailed remarks or processing stages may not be visible

- Login-based tracking provides more accurate and complete updates

For the best experience and full visibility, using the UAN login method is strongly recommended.

Types of EPFO Claims You Can Track

EPFO allows members to submit and monitor different types of claims, each designed for a specific purpose.

1. Partial PF Withdrawal (Form 31)

This claim type is used when members need funds during service for specific reasons such as:

- Medical emergencies

- Higher education

- Marriage

- Home purchase, construction, or renovation

Only a portion of the PF balance is withdrawn under this form.

2. Final PF Settlement (Form 19)

Form 19 is used when an employee:

- Leaves a job

- Does not join another EPF-covered organization

- Has completed the required waiting period

This claim allows withdrawal of the entire PF balance.

3. Pension Withdrawal (Form 10C)

Form 10C is applicable when:

- The member’s service period is less than 10 years

- Pension benefits are being withdrawn instead of transferred

4. PF Transfer Claim

This claim is used to transfer PF balance from a previous employer to a new employer when changing jobs.

All these claims can be tracked online using the EPFO claim status feature.

Understanding EPFO Claim Status Messages

When you check your claim status, you will see one of the following messages. Understanding them helps you know what to expect next.

Claim Received

Your application has been successfully submitted and acknowledged by EPFO.

Under Process

EPFO is verifying your claim details, including KYC, employment records, and eligibility.

Approved

Your claim has passed all checks and is approved for payment.

Settled

The approved amount has been transferred to your registered bank account.

Rejected

The claim has been rejected, and the portal usually displays the reason for rejection.

Knowing these messages helps you take appropriate action at the right time.

Common Reasons Why EPFO Claims Get Rejected

PF claims are often rejected due to small errors or missing information. Common reasons include:

- Aadhaar not linked or not verified with UAN

- KYC documents not approved by the employer

- Incorrect bank account number or IFSC code

- Name mismatch across Aadhaar, PAN, and EPFO records

- Date of birth mismatch

- Incomplete or incorrect claim details

Most rejections are not permanent. Once the issue is corrected, the claim can be submitted again through the EPFO portal.

How Long Does EPFO Claim Settlement Take?

The claim settlement time depends largely on document accuracy and verification status.

- Standard processing time: 7 to 20 working days

- Auto-settlement cases: 24 to 72 hours (when KYC is fully verified)

Delays usually occur due to:

- Employer approval pending

- KYC mismatches

- Bank account verification problems

Keeping all records accurate helps avoid unnecessary delays.

Tips to Get Faster EPFO Claim Settlement

To ensure quick processing of your PF claim, follow these best practices:

- Link and verify Aadhaar, PAN, and bank account with UAN

- Ensure personal details match exactly across all documents

- Use the same bank account registered on the EPFO portal

- Avoid submitting multiple claims for the same purpose

- Track your claim status regularly for updates

Proper preparation can significantly speed up the settlement process.

Why Tracking EPFO Claim Status Is Important

Tracking your EPFO claim status is not just a formality—it is a smart financial practice. It helps you:

- Stay informed about your PF withdrawal progress

- Detect errors early and correct them

- Avoid repeated visits to EPFO offices

- Plan expenses based on expected payment timelines

With EPFO’s digital systems, claim tracking has become transparent, efficient, and user-friendly.

Final Words

EPFO claim status tracking gives members complete visibility and control over their Provident Fund withdrawals. Whether you are withdrawing PF due to a job change, emergency, or retirement, knowing how to track your claim ensures a smooth and stress-free experience.

If your KYC details are accurate and your profile is updated, EPFO’s online system can process claims quickly—sometimes within just a few days. Make it a habit to keep your EPFO records updated and monitor your claim status regularly to avoid delays and confusion.